georgia estate tax calculator

Compare your rate to the. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

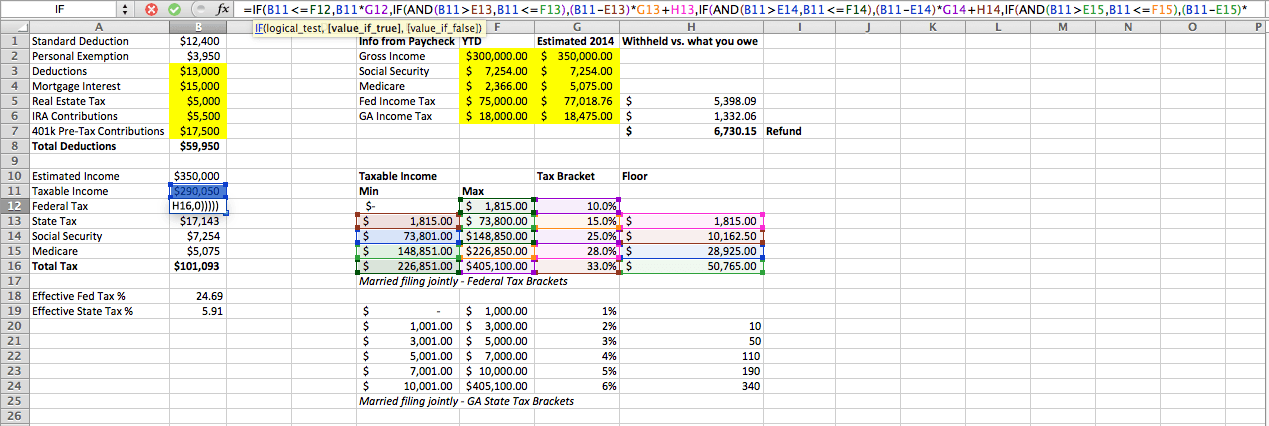

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Customize using your filing status.

. Our calculator has recently been updated to include both the latest Federal Tax. Seller Transfer Tax Calculator for State of Georgia. The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state.

Property Taxes in Georgia. Atlanta Title Company LLC 1 404 445-5529 Residential and Commercial Real Estate Lawyers 945 East Paces Ferry Rd Resurgens. County Property Tax Facts.

Some areas do not have a county or local transfer tax rate. This tax is based on the value of the vehicle. For comparison the median home value in Jefferson County is 7450000.

For comparison the median home value in Georgia is. In Georgia property is required to be assessed at 40 of the fair market value unless otherwise specified by law. Counties in Georgia collect an average of 083 of a propertys assesed fair.

The State millage rate on all real and. Garden City GA. To calculate the exact property tax saving a Southbridge property owner would realize if annexed into Garden City enter your property value into the box below.

Property Tax Returns and Payment. One of the biggest considerations in reaching this goal is the federal estate. However because Georgias highest income bracket tops out at 7000 10000 if married filing jointly per year the vast.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. 48-5-7 Property is assessed at the county level by the Board of. Property Tax Homestead Exemptions.

This means the higher your income the higher your tax rate. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Jefferson County. The tax must be paid at the.

You are able to use our Georgia State Tax Calculator to calculate your total tax costs in the tax year 202223. The average county and municipal millage rate is 30 mills. For comparison the median home value in Greene.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Habersham County. A tax rate of one mill represents a tax liability of one dollar per 1000 of assessed value.

Georgia Income Tax Calculator - SmartAsset Find out how much youll pay in Georgia state income taxes given your annual income. The Estate Tax Calculator estimates federal estate tax due. This calculator is mainly.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. For comparison the median home value in Habersham County is 14460000. The median property tax in Georgia is 134600 per year for a home worth the median value of 16280000.

The real estate transfer tax is based upon the propertys sale price at the rate of 1 for the first 1000 or fractional part of 1000 and at the rate of 10 cents for each additional 100 or. Many states impose their own estate taxes but they tend to be less than the federal estate tax. Georgia Estate Tax Calculator.

Georgia Property Tax Calculator - SmartAsset Calculate how much youll pay in property taxes on your home given your location and assessed home value.

Georgia Retirement Tax Friendliness Smartasset

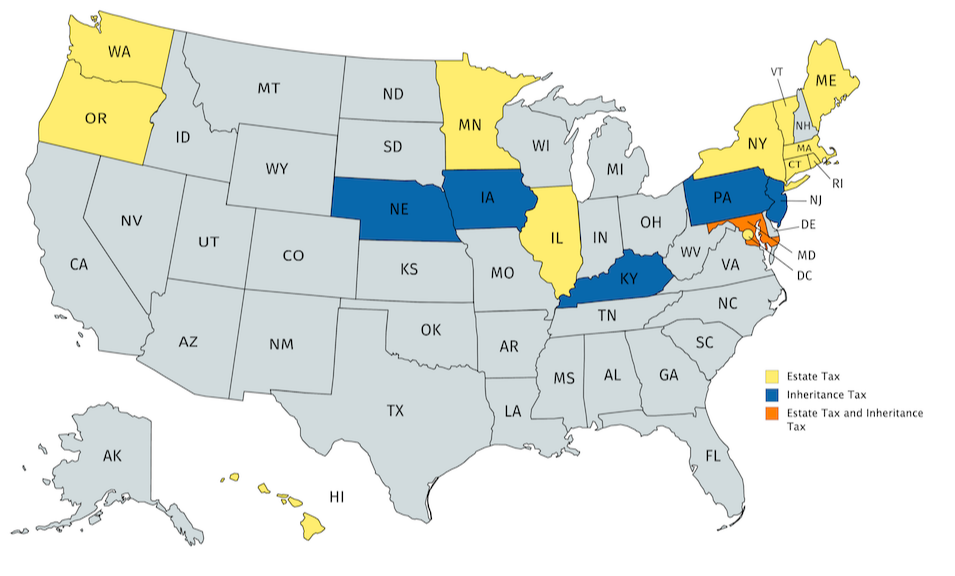

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Estate Tax Definition Tax Rates Who Pays Nerdwallet

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

The Estate Tax And Real Estate Eye On Housing

Georgia Health Legal And End Of Life Resources Everplans

What You Need To Know About Georgia Inheritance Tax

Step Up In Basis Archives Policy And Taxation Group

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Solved Computing Federal Estate Tax Due Nam Date Amount Chegg Com

Monday Map Inheritance And Estate Tax Rates And Exemptions Tax Foundation

Estate Tax Introduction Video Taxes Khan Academy

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Estate Tax Exemption Amount Goes Up For 2022 Kiplinger

Estate Tax Current Law 2026 Biden Tax Proposal

State Estate And Inheritance Tax Treatment Of 529 Plans

State Tax Levels In The United States Wikipedia

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download